Understanding Purchase and Sale Agreements

In the dynamic world of real estate, understanding purchase and sale agreements is crucial for both buyers and sellers, as these agreements outline the essential terms and conditions of any property transaction. This blog post breaks down the essentials of these agreements, to help provide a smoother and more informed experience.

What is a Purchase and Sale Agreement?

A purchase and sale agreement (PSA) is a legally binding contract between a buyer and a seller that sets out the terms of a real estate transaction. This document ensures that both parties are clear on their obligations and the conditions of the sale, minimizing the risk of misunderstandings and disputes.

Key Elements of a Purchase and Sale Agreement

- Buyer and Seller Information: Names and contact details of both parties involved in the transaction.

- Property Details: Specifics of the property being sold, including the address and legal description.

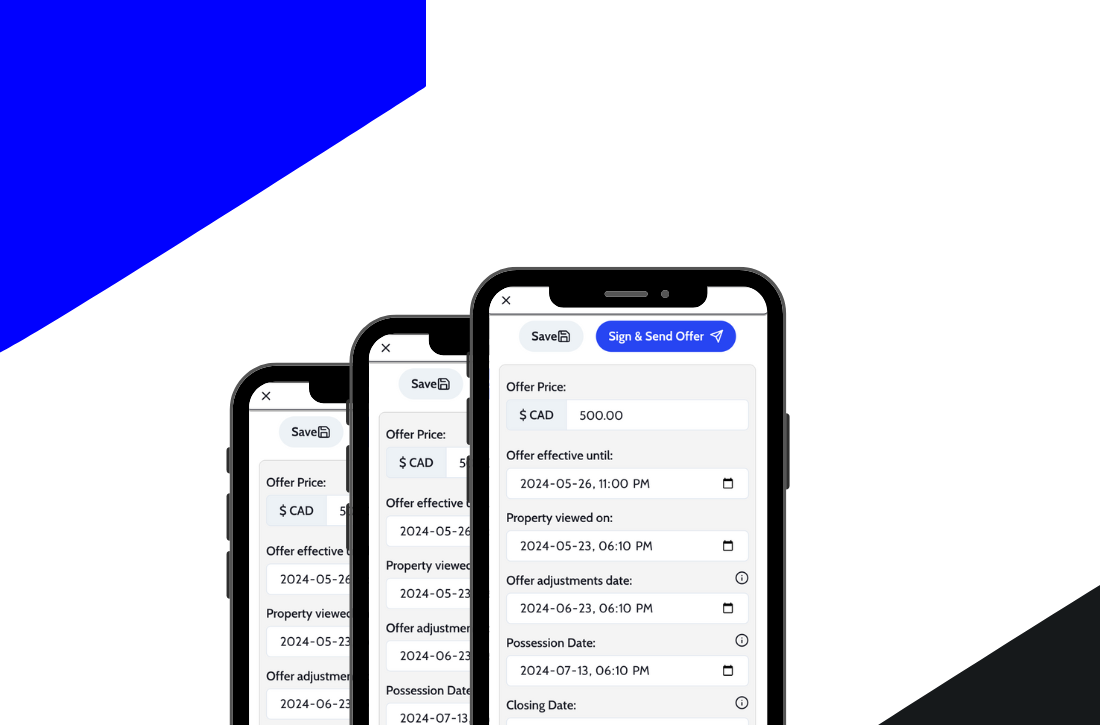

- Purchase Price: The agreed-upon amount the buyer will pay for the property.

- Terms and Conditions: Specific conditions that must be met for the sale to proceed, such as financing terms and the condition of the property.

- Contingencies: Provisions that allow the buyer or seller to back out of the agreement if certain conditions are not met (e.g., satisfactory home inspection, securing financing).

- Dates:

- Closing Date: The date when the ownership of the property will be transferred from the seller to the buyer.

- Adjustment Dates: Dates on which various expenses related to the property, such as property taxes or utility bills, are adjusted between the buyer and seller.

- Possession Date: The date on which the buyer takes possession of the property.

- Effective Date: The date when the purchase and sale agreement becomes legally binding.

- Deposit Information: The amount of earnest money or deposit provided by the buyer to demonstrate their commitment to the purchase.

- Offer Signing Deposit Amount: Additional deposit amount required upon signing the offer to demonstrate serious intent.

- Cost Breakdowns: Breakdown of costs associated with the transaction, including closing costs, taxes, and fees.

- Post-Inspection Amount: Additional deposit amount that may be required after the home inspection, based on any negotiated repairs or adjustments.

Understanding Contingencies

In real estate purchase and sale agreements, contingencies are critical conditions that must be met for the transaction to proceed. These clauses protect both buyers and sellers by ensuring essential conditions are satisfied before finalizing the sale, reducing risks and unforeseen obligations.

Common Contingencies and Their Implications

Common contingencies are standard conditions included in purchase and sale agreements to protect both buyers and sellers. These typically involve:

- Financing Contingency: Ensures the buyer can back out if they are unable to secure financing.

- Home Inspection Contingency: Allows the buyer to renegotiate or withdraw the offer if significant issues are found during the inspection.

- Sale of Buyer’s Property: Makes the purchase contingent upon the buyer selling their current home.

Custom Contingencies and Their Implications

Custom contingencies are additional conditions that buyers or sellers may add to the purchase and sale agreement to meet their specific needs or concerns. These could include clauses related to:

- Appraisal Contingency: Requires the property to appraise for a certain value to proceed with the sale.

- Title Contingency: Ensures that the property has a clear title and is free from any legal encumbrances.

- Repair Contingency: Specifies repairs or improvements that the seller must complete before the sale can proceed.

- Condo Documents Review: Allows the buyer to review and approve condominium association documents before finalizing the purchase.

Each custom contingency serves to protect the interests of the buyer or seller and should be carefully negotiated and documented in the purchase and sale agreement.

Negotiating the Offer: Counteroffers and Acceptance

Sellers may respond with a counteroffer, modifying certain terms such as the price or closing date. Buyers can accept, reject, or counter the counteroffer. This negotiation continues until both parties reach an agreement or decide to part ways.

Importance of Deadlines and Timelines

Adhering to deadlines for responses, inspections, and closing dates is crucial to keep the transaction on track. Missing a deadline can jeopardize the deal or result in financial penalties

Understanding the purchase and sale agreement and the offer process is vital for anyone entering the real estate market. By preparing thoroughly, making informed offers, and navigating negotiations effectively, you can increase your chances of a successful transaction. Always consider seeking professional advice from real estate agents and legal experts to guide you through this complex process.